January 28th, 2026

EPC Rating C – new deadline October 2030

An achievable goal or shooting for the stars?

EPC Ratings - New Deadline

All privately rented residential properties to have a minimum EPC rating of C by 2030

The Government has confirmed that all private sector landlords letting residential properties in England will have until 1 October 2030 to bring their properties up to a minimum EPC rating of C in order to continue renting them out. This single deadline will apply to both new and existing tenancies and represents a significant tightening of energy efficiency expectations for the private rented sector.

From a landlord perspective, the postponement of the original 2028 target is welcome breathing space. However, at Weir Bank Group (WBG), we question how achievable the 2030 goal really is once you look at the scale of the task, the cost of improvements and the likely impact on rental supply and values.

Where the market stands now

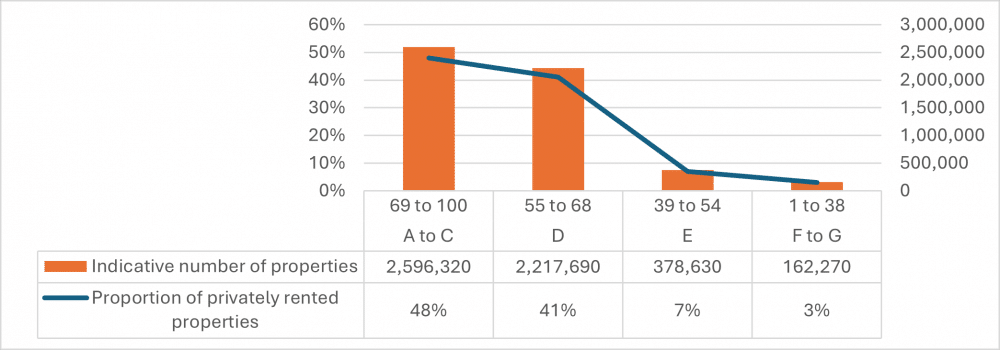

The 2023 English Housing Survey estimates there are around 5.4 million residential properties in the private rented sector, of which roughly 4.9 million are currently let and 0.5 million are vacant. Less than half (48%) of these properties achieve an EPC rating of C or higher, leaving just over half – around 2.75 million units – below the new minimum target.

Within that 2.75 million, about 2.2 million properties (41% of total supply) are rated D, while around 540,000 (10%) sit in the E to G bands. That means a very large proportion of the sector will need work in the next few years if landlords are to remain compliant and able to let their homes legally.

Source: English Housing Survey 2023

The cost of getting to EPC C

According to the English Housing Survey 2023, the average cost of upgrading a sub‑C property in the private rented sector to EPC C is around £6,864 per unit. Applied to roughly 2.75 million homes, that implies a total bill in the region of £19 billion to bring the entire sub‑C rented stock up to the new minimum.

Other estimates suggest the true cost could be much higher. Savills, for example, put the average cost of moving from D to C at £8,807 and from G to C at £27,366, highlighting how steep the financial outlay can become for the least efficient stock. The Government intends to keep a spending cap at £10,000 per property, with a lower cap linked to value for homes under £100,000, and to offer some support with upgrades. Even so, the scale of investment required from landlords remains very significant.

Set against an approximate gross annual rental income of £84 billion for the sector (assuming an average rent of £1,424 per month and around 4.9 million let units), the headline upgrade cost might look manageable. But once you factor in operating costs and expenses, the picture changes. HMRC data for 2023–24 suggest that net income after expenses but before tax is only about 48% of gross. On that basis, the projected upgrade costs equate to just under half of one year’s net income for the sector as a whole – a far more material hit.

As an illustration of the potential scale of investment needed, DEFRA figures are that the agricultural sector’s total contribution to the UK economy (Gross Value Added at basic prices) in 2024 was £14.5 billion.

What landlords gain from better EPCs

There is some anecdotal evidence that better EPC ratings can support slightly higher rents, but at present the link between rating and rental value is not especially strong or consistent. In our view, the more immediate benefits for landlords lie elsewhere: improved tenant attraction and retention, lower energy bills for occupiers, reduced arrears risk linked to fuel poverty, and a stronger environmental profile.

By contrast, the evidence that higher EPC ratings support higher capital values is more compelling. Several studies show a positive correlation between EPC bands A to C and higher sale prices and purchaser demand, suggesting that energy performance is increasingly priced in by buyers. For some landlords, the capital uplift may ultimately be as important as any rental upside.

The risks: supply, cost and timing

The Government’s objective – cutting energy use and emissions in the rented sector – is, in principle, a positive and necessary step. The question is whether the current framework can deliver this without harmful side effects.

We see four key risks:

- The volume of stock needing work is enormous. Just over half the privately rented sector – around 2.75 million homes – must be lifted to C in what, in property terms, is a short period.

- The most inefficient stock (E to G) is also the most expensive to upgrade. A sizeable minority of landlords may decide that the numbers do not stack up and opt to sell or repurpose these assets rather than invest heavily, reducing rental supply.

- Even for D‑rated properties, some landlords will struggle to fund upgrades in the required timeframe, especially in lower‑value or lower‑rent markets. If only 10% of D‑rated homes left the rental sector, that would mean a loss of around 220,000 units.

- Any material reduction in supply in a market already under pressure is likely to push rents higher, undermining affordability for tenants – the very households the policy is, in part, designed to help.

Taken together, these factors suggest that, without adjustment, the 2030 EPC C requirement risks being self‑defeating: it may improve the quality of some homes while making them more expensive and scarcer overall.

A more realistic, tiered approach

WBG believes the Government could significantly improve the odds of success by adopting a more flexible, medium‑term, tiered pathway rather than attempting to move more than half the sector to C in one leap.

For D‑rated properties, which make up 41% of the privately rented stock, we suggest a split of the current band into two sub‑bands:

- D(i): EPC scores 62–68

- D(ii): EPC scores 55–61

Under this model, properties in D(i) would be required to reach C by the current 2030 deadline. Those in D(ii) would be required to reach at least D(i) by 2030, with a further three to four years to achieve C. This staged approach would prioritise the “easy wins” while giving owners of slightly weaker D‑rated homes longer to plan and finance more substantial works.

For properties rated E to G, where upgrade costs are highest, we favour a rule requiring landlords to improve each property by at least one EPC band every three to four years. This would keep momentum towards C while spreading costs, reducing the risk of fire‑sale disposals and mass exits from the sector.

We see this “tortoise, not hare” approach as more likely to deliver genuine, sustainable progress towards the Government’s longer‑term decarbonisation goals without triggering a shock to rental supply.

WBG’s position and outlook

WBG’s own residential rental portfolio is already well‑placed against the proposed standards:

- The significant majority of our properties are rated C or higher.

- Only a very small number are rated D, and these are at the upper end of the band (with a minimum score of 64).

- None of our properties are rated E to G.

As a result, the direct impact of the new regulations on WBG is limited, which we believe allows us to take a relatively objective view of the policy landscape.

In summary, the intention behind the 2030 EPC C requirement – to reduce energy consumption, lower bills and cut emissions – is a sound and necessary one. However, the combination of the number of properties affected, the cost of upgrades and the tight implementation timeframe makes the current framework extremely challenging. Without a more flexible, tiered and time‑phased approach, there is a real risk that the policy will reduce rental supply and drive up rents, undermining affordability and making life harder for the very tenants it is intended to support.

Author: Matthew Wright, Weir Bank Group

Matthew Wright manages WBG’s residential & commercial properties in Worcester while also advising on the company’s wider portfolio. Matthew has recently returned to the UK after spending 18 years in Muscat where he was a Director and the Head of Strategic Consultancy for Savills’ Oman office.